Perpetual futures contracts, commonly referred to as perps, allow traders to use leverage to speculate on the pice action of an asset. Since inception, perps have become the most popular way to trade crypto – making up roughly 75% of all onchain and crypto volume. Despite their clear volume dominance, perps are still relatively elusive to new-bee (and seasoned) crypto traders. Let’s dive into what perps are, when to use them, their use cases, and how Perpl fits into the mix.

What are perps?

Perps are a type of derivative contract that allow traders to long or short the future price of a token, without actually holding the underlying asset. Unlike traditional futures contracts, which have set expiration dates, perps have no expiration date.

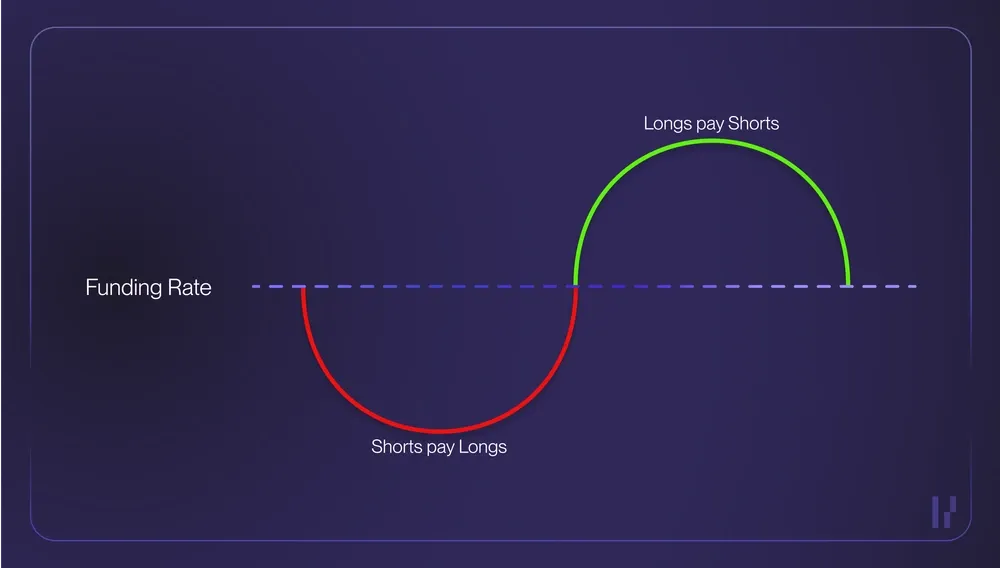

Without expiration dates, perpetuals need a way to reflect the spot price. That’s where funding rates come in. Funding rates are periodic payments exchanged between longs and shorts, typically every few hours.

- If more users are taking out longs, longs pay shorts.

- If more users are shorting a token, shorts pay longs.

This creates incentives for traders to take the less popular position and correct the price discrepancy. The funding rate is usually annualized, and users can see how expensive or inexpensive it is to hold onto a position when they open it.

Why Do Traders Use Perps?

There are a few reasons why perps have become the go-to product for active crypto traders:

- Shorting made simple: Spot markets only let you buy and sell the asset itself – meaning you can only profit if price goes up. Perps make it easy to take a short position and profit from falling prices.

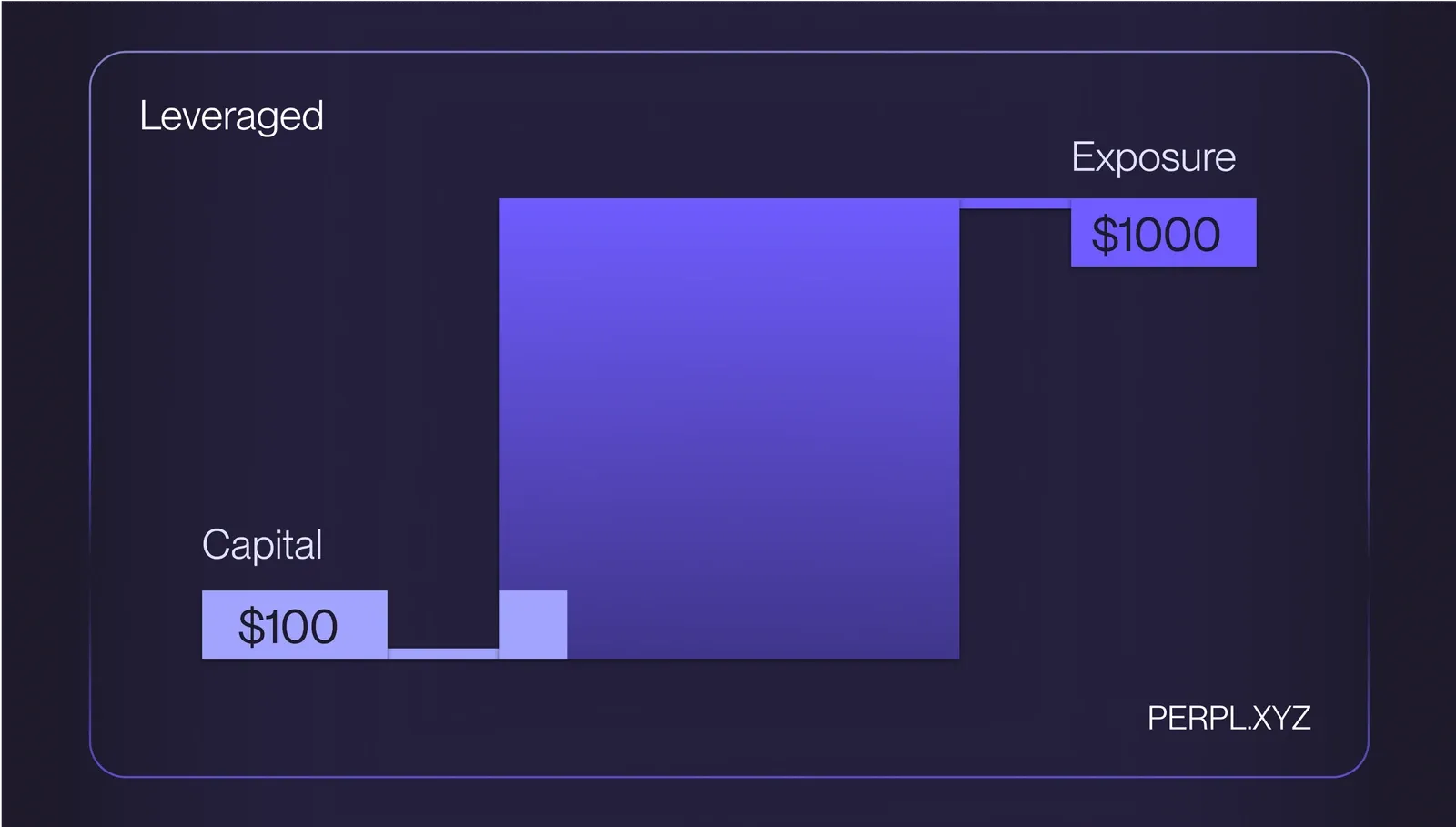

- Leverage: With perps, you can use leverage to control a bigger position with less capital. For example, 5x leverage means you can open a $5,000 position with just $1,000. This amplifies both gains (and losses).

- Capital efficiency: Traders don’t need to tie up large amounts of capital to take meaningful positions. That frees up capital for other strategies or risk management.

- Deep liquidity and accessibility: On popular assets, perp markets often have more volume and tighter spreads than spot markets, making them more attractive for high-frequency or large-size traders. Additionally, markets are open 24/7 to trade.

Things to keep in mind when trading perps

Perps give traders flexibility and power, but they can also introduce additional risk. It’s important to keep these things in mind before opening a trade:

- Leverage cuts both ways: Just as it can multiply profits, leverage can quickly wipe out a position if the market moves.

- Liquidations: Exchanges automatically close positions when your margin falls below a maintenance threshold. If you’re overleveraged or the market is volatile, this can happen fast - leading to a loss of funds.

- Funding payments: Since perps don’t expire, they use a mechanism called "funding" to keep their price close to spot. Depending on market conditions, you may pay or receive funding periodically. This is a bonus (or cost) that adds up over time

Common Use Cases for Perps

There are plenty of ways to benefit from using perps. Most commonly:

- Speculation: Make directional bets on price with more flexibility and lower capital requirements than spot.

- Hedging: Offset exposure to assets you hold without selling them.

- Arbitrage: Exploit differences in pricing between perp markets, spot, or futures across exchanges. Delta-neutral arbitrage by taking opposing positions to take advantage of the funding rate (i.e short the perp but long the underlying spot asset).

Why Perpl?

Perpl is the first perpetual DEX built on Monad, a high-performance blockchain designed for 10,000 transactions per second. This matters because:

- Perpl uses an onchain order book – offering tighter spreads and more accurate pricing.

- Historically, CLOBs were hard to scale onchain due to performance limits. Monad changes that.

- Traders get a fast, reliable, and fully non-custodial experience that feels like a centralized exchange – but without giving up control of your assets.

Perps aren’t new. But a high-speed, order book-based perp DEX on Monad? That’s a first. Learn more at perpl.xyz