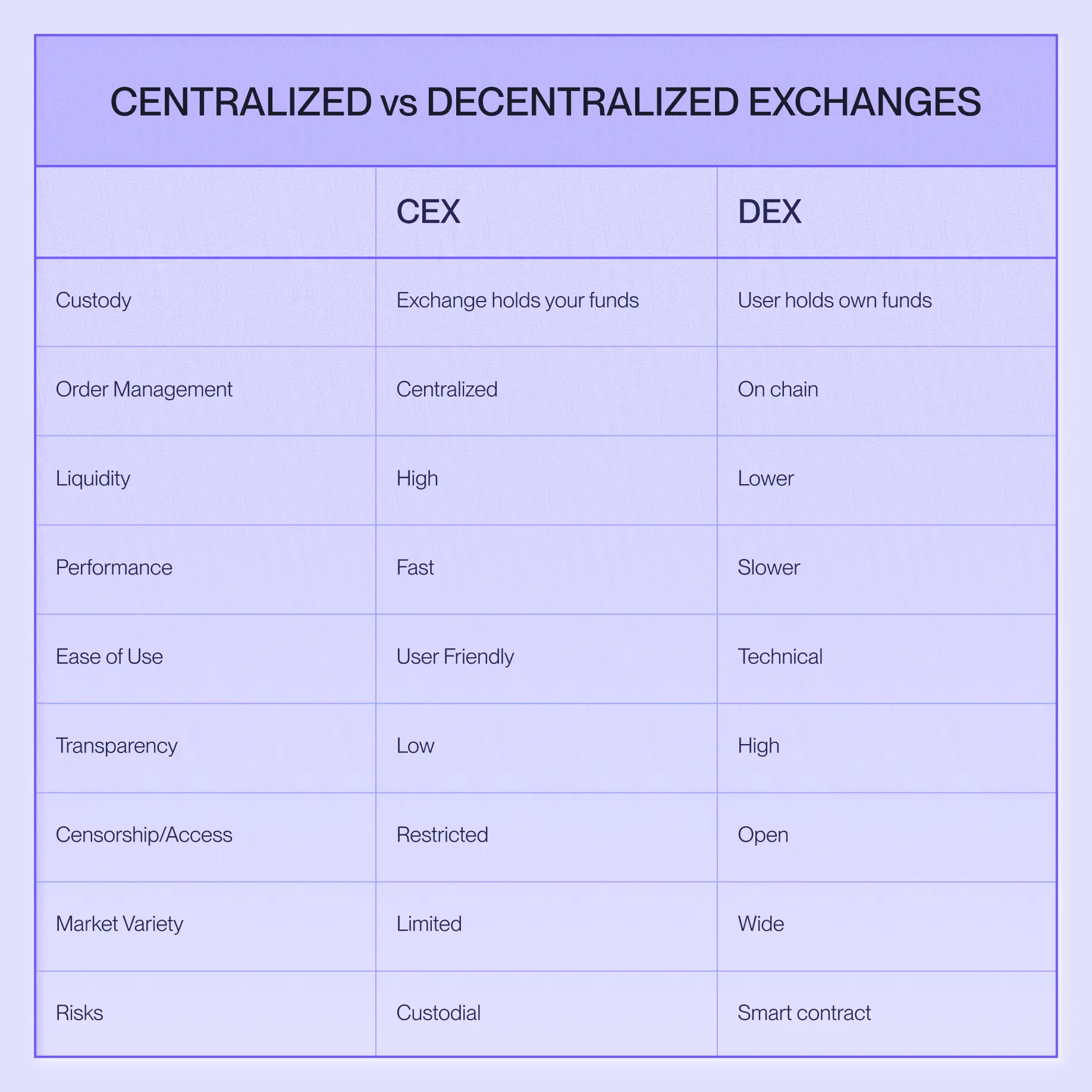

Exchanges are where trading happens and they come in two very different flavors: centralized exchanges (CEXs) and decentralized exchanges (DEXs). Understanding the differences, benefits, and trade-offs between the two types of exchanges is crucial for traders as they navigate the crypto landscape. Let's dive into the differences between the two exchange types and why Perpl has chosen to build a decentralized exchange.

Centralized Exchanges

CEXs, such as Binance, Coinbase, and Kraken, function similarly to traditional financial institutions. They hold custody of user funds, manage order books centrally, and facilitate trades off-chain. Centralized exchanges have a wide range of benefits including:

- High liquidity and trading volume: Centralized exchanges dominate market share and have more institutional buy in, which translates to deep liquidity and tighter spreads.

- Performance: Faster order execution times due to centralized infrastructure

- Ease of use: User-friendly interfaces and familiar onboarding experiences as well as customer service for any issues that may arise

While there are many pros to CEXs, and trading on CEXs makes up the majority of crypto trading, they don’t come without a downside. Some major downsides of CEXs include:

- Custodial risks: Users must trust the exchange with their assets, making funds susceptible to hacks, mismanagement, or regulatory seizures.

- Lack of transparency: Order matching and settlement processes occur off-chain, limiting auditability.

- Censorship and access issues: Centralized exchanges often enforce geographic and regulatory restrictions.

- Limited Markets: Assets are usually limited to a few assets to trade compared to onchain markets. Listing teams and committees are needed to add new markets and often list assets much later than DEXs.

Decentralized Exchanges:

DEXs like Uniswap, Hyperliquid, and now Perpl, offer a non-custodial alternative, allowing users to retain complete control over their assets. Trades occur directly onchain or via transparent smart contracts and typically have a wider range of tradable assets. DEX benefits include:

- Full asset control: Users maintain full custody and security of their assets at all times.

- Transparency: All trades and settlements are verifiable onchain, enhancing trust and auditability.

- Censorship resistance: Anyone with an internet connection can participate without restrictions.

Decentralized exchanges target and fix many of the issues that come with centralized trading. However, DEXs historically haven’t been a total fix all solution. Common problems with DEXs include:

- Historically lower liquidity: DEXs have traditionally had less liquidity than their centralized counterparts, though this gap is narrowing quickly.

- Performance limitations: Traditional onchain DEXs faced scalability and performance issues, limiting their appeal for high-frequency traders and large transactions.

- Difficult UX: Onboarding and interaction with decentralized platforms is less intuitive for newcomers.

So Why Did Perpl Build a DEX?

As outlined above, there are many benefits to building a DEX and Perpl is introducing solutions to tackle the cons head on. Perpl is a next-generation perpetual futures DEX build on Monad that is limiting many of the issues that make DEX trading clunky now:

- Introducing an Onchain Central Limit Order Book (CLOB): Unlike most traditional DEXs using Automated Market Makers (AMMs), Perpl leverages an onchain order book, providing tighter spreads, higher precision, and deeper liquidity, previously exclusive to CEXs.

- Monad’s High-Performance Infrastructure: Perpl capitalizes on Monad’s parallel execution capabilities, allowing for up to 10,000 transactions per second. This vastly improves speed and reduces costs, enabling decentralized exchanges to match or even surpass the efficiency of centralized solutions.

- Non-Custodial and Secure: Users retain full custody, reducing counterparty risks. Trading remains entirely transparent and verifiable on-chain, blending the security advantages of DEXs with performance benefits traditionally reserved for centralized platforms.

Addressable Market and Future Outlook

The decentralized exchange market is expanding rapidly. While CEXs still dominate overall volume, the growth rate of DEX usage, particularly in derivatives and perpetual markets, significantly outpaces centralized counterparts. Perpetual futures alone represent roughly 75% of total crypto trading volume, making them a prime target for disruption by performant decentralized alternatives.

As regulations tighten globally around centralized entities and users become increasingly security-conscious, DEX adoption is poised for significant growth. Platforms like Perpl, that offer CEX-level performance while maintaining full decentralization are primed to capture substantial market share.

Perpl’s architecture combines the best of centralized performance and decentralized transparency. By addressing historical limitations around liquidity, speed, and ease of use, Perpl is positioned to become a core infrastructure provider for the decentralized trading landscape. Traders seeking security, transparency, and top-notch trading will find all of these features and more within the Perpl trading experience.

Follow our journey on X for more updates as we bring Perpl to mainnet.