Perps dominate the crypto market with roughly 75% of all trade volume. And while spot DEX trading has reached as high as 20% of all spot trades, DEXs only process roughly 5% of all perp volume—meaning that despite growing competition, DEXs still can’t stack up against CEXs.

Exchanges like Hyperliquid, have recently come on the scene—offering traders a UX that mimics CEXs without the hassle of KYC. And for a while, it seemed like Hyperliquid might finally be the DEX that overtakes CEXs. However, overthrowing legacy systems demands relentless precision and near-perfection—qualities Hyperliquid has recently been scrutinized for lacking.

In March, Hyperliquid was “exploited” for ~$12M which highlighted the dangers of chasing growth at the expense of resilience. In short, a user manipulated the markets forcing Hyperliquid to either lose millions of dollars or step in and prove their decentralized exchange isn’t as decentralized as it claims. Hyperliquid did the latter. In this post, we’ll take a look at the tradeoffs and accompanying risks Hyperliquid took on for the sake of growth.

Protocol Tradeoff

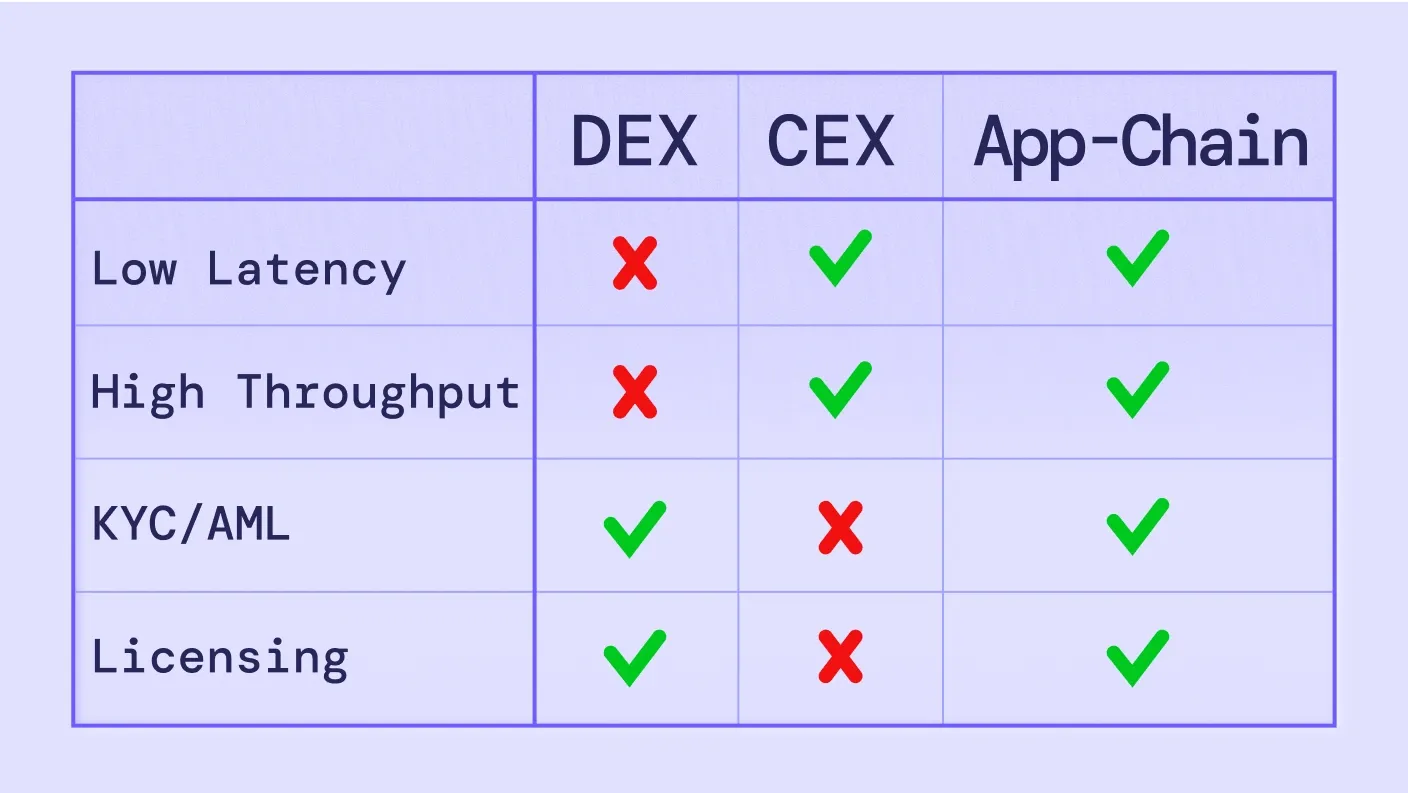

Historically, DEXs have struggled to keep up with CEXs due to latency and compute limits. But CEXs are bogged down by KYC and licensing burdens. The dream? Build your own L1.

Building an L1 (layer 1 or standalone blockchain) allows you to:

- Decrease gas costs

- Introduce specialized opcodes (funding/oracles)

- Support specialized order types (cancel)

- Onboard users without KYC

And that’s what many DEXs have done. Take dYdX, Hyperliquid, Zeta and Aevo as examples—all projects who built their own L1 or L2 in order to handle the high throughput perps require while benefiting from complete control of the stack.

However, with great power comes great responsibility. If you act powerless when DPRK trades on your platform, but you manipulate the system when your protocol is exploited, you are basically building a CEX with extra steps. No credible neutrality means no decentralization.

By stepping in post-exploit, Hyperliquid opened Pandora’s box—inviting scrutiny from regulators, competitors, and power users. Moreover, the large players (whales, protocols, institutions, market makers) are going to be hesitant to trade on a platform that has the right to arbitrarily undo profitable trades.

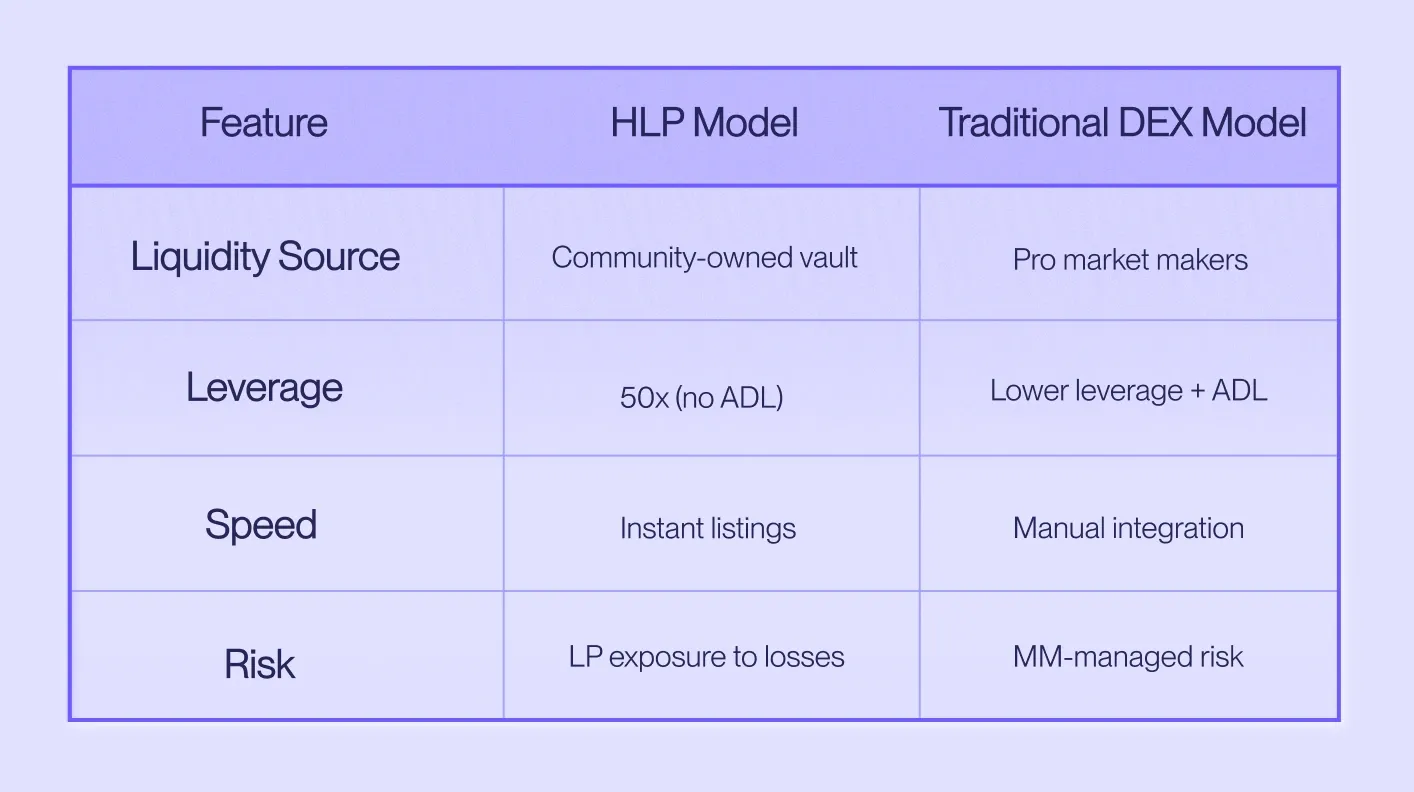

Liquidity Tradeoff

Hyperliquid’s passive liquidity pool (HLP), was a clever workaround: bypass the need for pro market makers on day one, pass profits to LPs, and bootstrap liquidity fast. It also enabled fast market listings and high leverage because HLP serves as the backstop and liquidator.

Because of the hyper-growth mindset and cheaply available liquidity, critical components to ensure safe operations of the DEX were underdeveloped. No other exchange offers such high leverage with size as Hyperliquid. Automatic deleveraging (ADL), a feature of many other exchanges, didn’t trigger for these conditions like it should have.

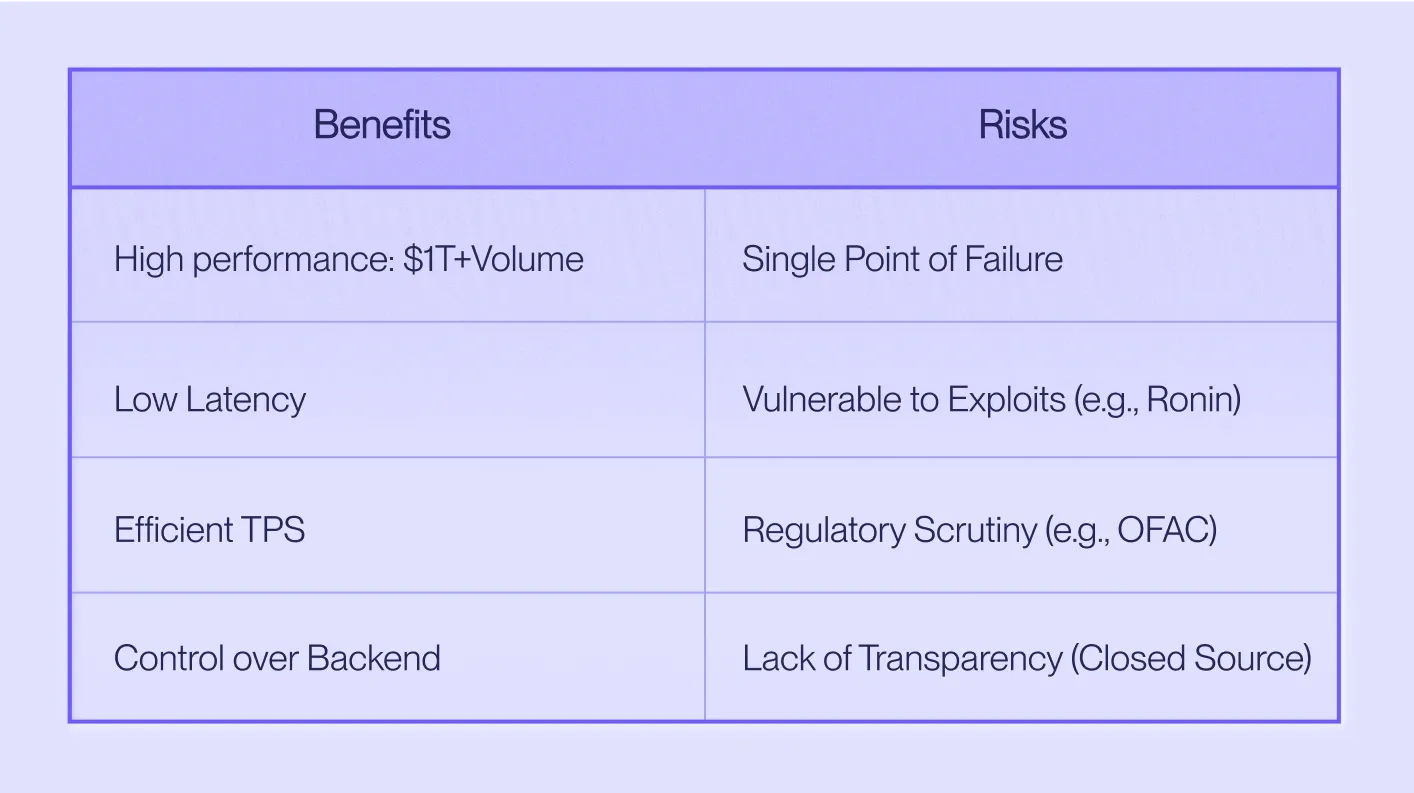

Decentralization Tradeoff

Decentralization is often a tremendous burden when bootstrapping a new network due to social, technological, and monetary costs. Hyperliquid decided to have a small co-located validator set with completely opaque software to minimize latency and exploit risks. This allowed them to process over a trillion in trading volume in less than 2 years.

Too often, decentralization has been used as a buzzword or for virtue signaling, so when industry experts raise alarm bells, the loud minority drowns them out as alarmists. However, as we have seen in the past, OFAC sanctions (see Tornado Cash) and compromised validator sets (see Ronin) are not a matter of if, but when.

Many users have been commenting on the legitimate concerns over the true decentralization of the project for years. The same team runs the exchange, the validator set, the liquidity pool, and the backend. HLP has advantages no external MM can match—set mark price, liquidation priority, backend control. And add in the "validator put" for bad HLP trades, and you're basically running a casino with house odds.

You can argue that this is a better FTX because it’s onchain and non-custodial, but knowingly exposing your users to such risks cancels any goodwill. Proper decentralization is hard because you don’t have the undo button handy, or unlimited TPS that comes from being geographically co-located—but that’s the price you agree to pay for decentralization, right?

Historic Tradeoff

The early DEX era was dominated by AMMs—not because they were better, but because L1 infrastructure couldn’t support performant order books. Pro market makers weren’t interested in clunky execution, so AMMs were a necessary bootstrapping tool.

Teams eventually pivoted to “app-chains” to run CLOBs, with dYdX leading the way. However, they couldn’t list new markets as quickly as CEXs due to their reliance on external market makers. Hyperliquid succeeded where dYdX stumbled. By integrating the full stack—exchange, liquidity, validator set—they launched new markets at breakneck speed, ultimately taking mindshare and volume away from dYdX.

Inevitable Next Step

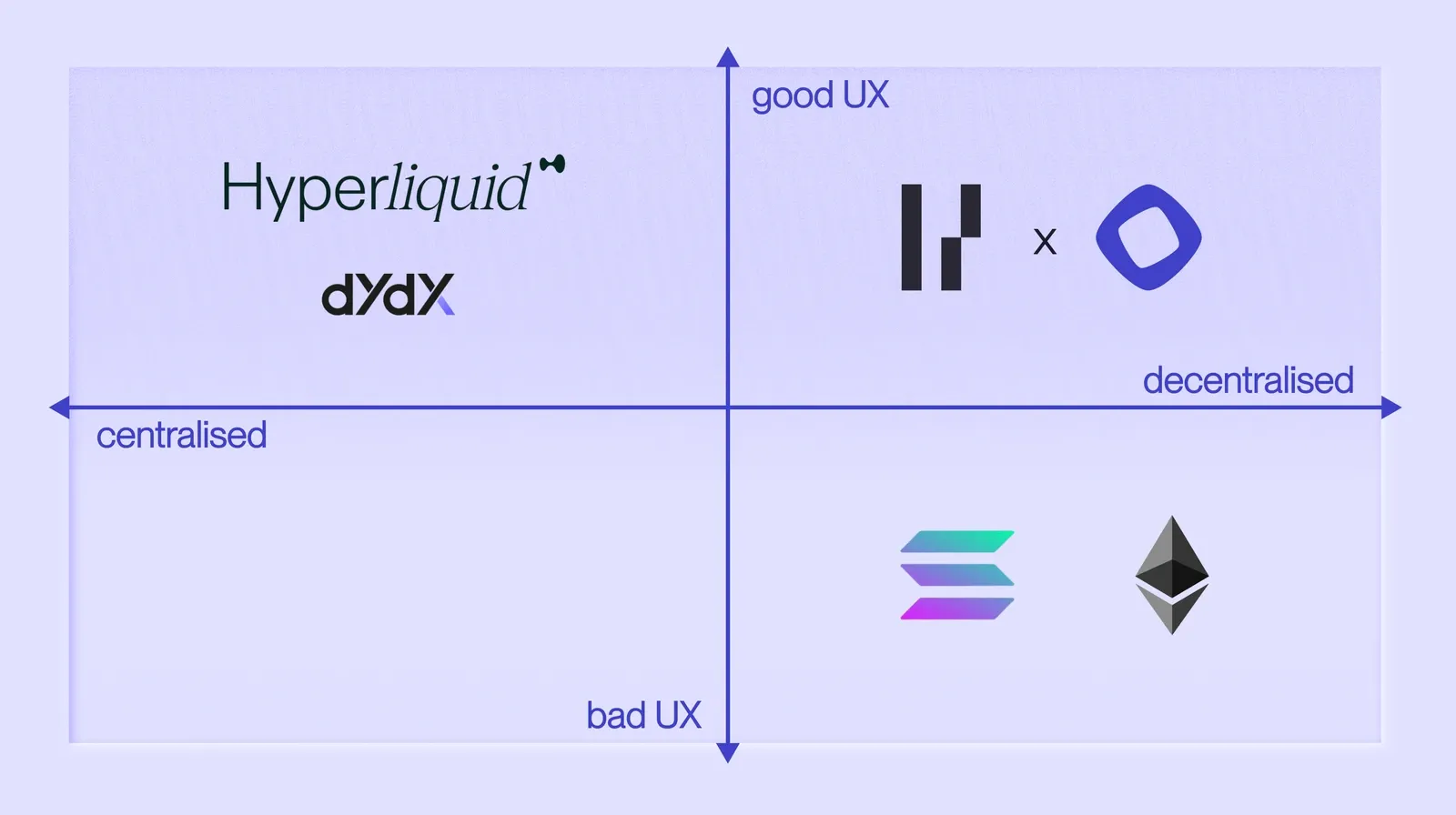

The optimal combination would be to have performant onchain DEX built on a standalone high throughput L1, and bootstrapped by independently operated vaults. Perpl is uniquely positioned to achieve this while honoring the boundaries between protocol, liquidity and infrastructure.

We believe in:

- Protocol: A performant onchain CLOB backed by a robust, transparent risk engine

- Liquidity: Independent vaults run by professional Market Makers with clear mandates (blue chips, meme coins, pre-markets, etc.)

- Blockchain: A decentralized, high-throughput L1 like Monad

We prioritize:

- Audited smart contracts

- Composable, developer-friendly architecture

- Transparent block explorers

- Fully traceable transaction history

- Secure bridges validated by 200+ nodes

- Native USD on-ramps

- An ecosystem with hundreds of live integrations

Most importantly, we believe users can have great UX and decentralization. One does not have to come at the expense of the other. With these values at the helm, we’re confident decentralized perp exchanges will finally have their time in the sun – and stay there.