Perps take trading to the next level. With leverage, flexibility, and the ability to speculate on ups and downs, more and more traders are jumping into the perp game with the hopes of reaping the benefits. But trading perps comes with risk and one of the most important risks to understand is liquidation. If you’re trading perps, knowing how and why liquidations happen can make or break your trading experience. In this blog we will unpack the mechanics of liquidations, the role of margin trading, how best to avoid getting liquidated and why liquidations are important to a healthy perp ecosystem.

What Is A Liquidation?

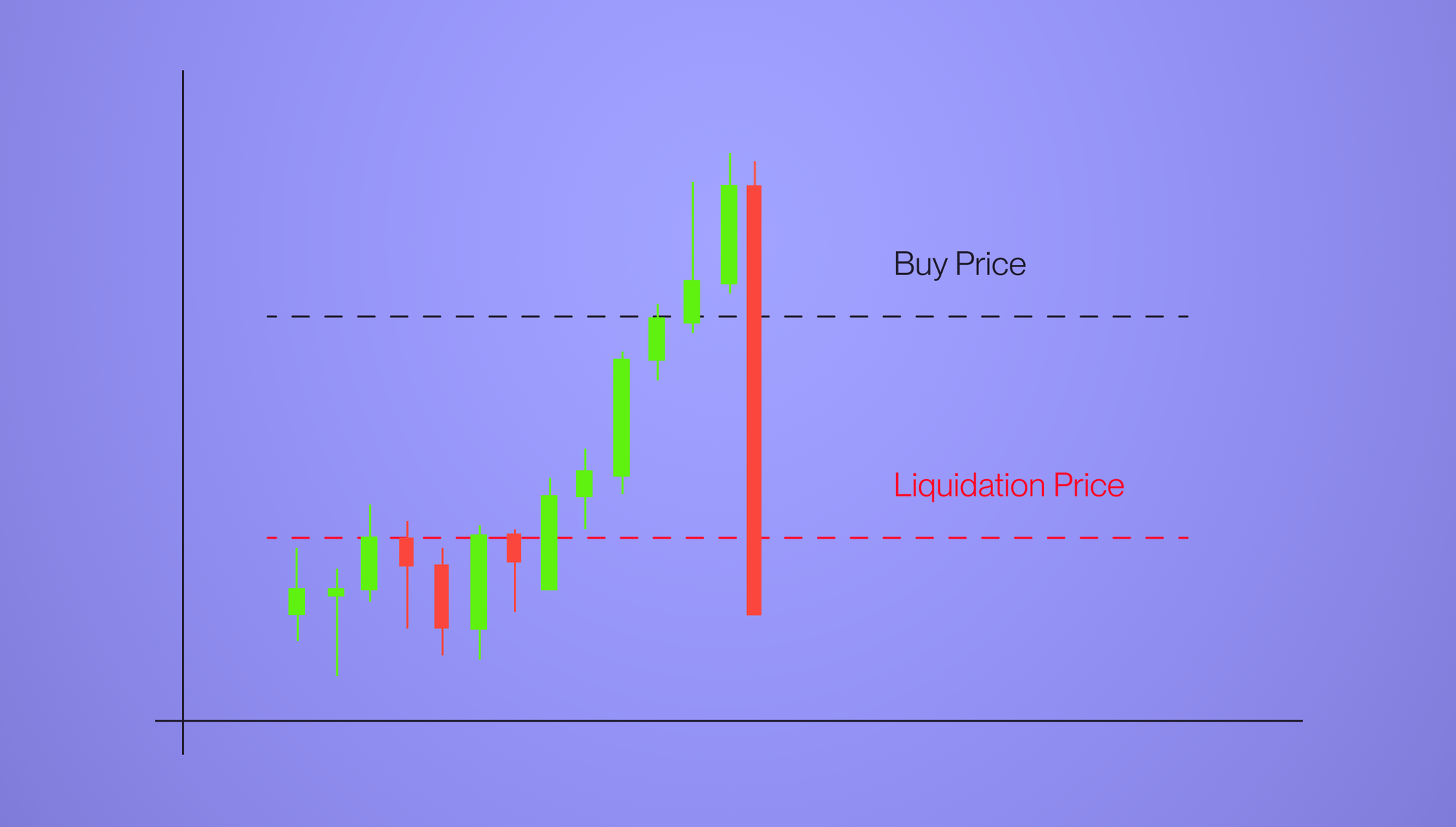

A liquidation occurs when a trader’s position is forcefully closed because their collateral is no longer sufficient to cover potential losses. This happens when the value of a position moves beyond a certain threshold.

Unlike spot trading where losses are limited to the initial investment, using leverage both amplifies both your upside and downside. When the market moves against a trade, losses can quickly erode a trader’s collateral and put them at risk for liquidation.

Understanding Margin

To understand liquidation risk, traders must understand how margin works. Margin is the amount of collateral required to open a position. For example, if a trader is using 10x leverage, they only need to post 10% of the position size as collateral. Using higher leverage means traders are more at risk for liquidation during smaller price fluctuations. For the 10x example, if price moves more than 10% in the opposite direction of the original trade, traders will be liquidated or forced to post more margin to keep the position.

Why Exchanges Need Liquidation

While getting liquidated sucks, it’s important for the maintenance of a healthy exchange. Liquidations protect the protocol and its users from insolvency. When traders use leverage, they’re essentially borrowing capital to amplify their positions. If the market moves against them and their collateral becomes insufficient, automatic liquidations close the position before it becomes undercollateralized. This ensures that losses don’t spill over into the protocol’s insurance fund or impact other traders. Without liquidation mechanics, the entire system could be at risk for cascading failures. The health of an exchange begins at the effectiveness of its core liquidation engine. If that falls short, there may be a second line of defence, which usually takes shape in the form of an insurance fund. In short, liquidations are a healthy part of maintaining the underlying risk engine of an exchange and allows traders to have much more capital efficiency with their capital.

A detailed example of how liquidation works

Imagine a trader opens a 1 BTC long position at $100,000 by posting $10,000 in margin, allowing them to control a $100,000 notional position with 10x leverage.

If the price of BTC drops by just 5% to $95,000, that position incurs a $5,000 unrealized loss – cutting equity in half. Now the trade only has $5,000 margin left for their notional exposure of $100,000.

If BTC drops another 5% to $90,000, the full $10,000 collateral is wiped out, and the position will be forcibly liquidated.

Risk Management: How to avoid liquidation

While liquidations are an integral part of perp exchanges, they are not inevitable. Traders can manage their positions actively and decrease their risk for liquidation in a few ways.

- Using lower leverage: Trading at a lower leverage rate gives traders more room to withstand price volatility.

- Set stop loss orders: Stop losses automatically close positions before a trade gets close to the liquidation zone.

- Monitor Margin Ratio: Most platforms show live margin ratios and liquidation price. Traders can make it a habit to check frequently and act accordingly to post additional margin or set stop losses for their positions.

- Check Order Books: Thin order books can lead to wicks that trigger liquidations prematurely. Traders should check the strength and liquidity of a market to make sure they understand the risks. Majors like BTC, ETH and SOL usually have much more liquidity than longer tail assets like low cap altcoins and are less prone to large wicks.

In Summary

Liquidations are not just a technicality, they’re a core part of the health of a perp exchange. Liquidation ensures systemic stability and allows traders to capture outsized returns through leverage. However, this cuts both ways as leverage can also catch new and experienced traders off guard.

Understanding liquidation mechanics and planning accordingly is a key part of any leverage traders day to day.

Stay up to date on Perpl on X or join our Discord.