Deposit From Any Chain to Trade Perpetual Futures on Monad

Perpl integrates Fun.xyz to enable deposits from 11+ chains, CEXes, VISA, and bank transfers. Trade fully onchain perpetual futures on the Monad EVM L1.

TL;DR

Perpl, the first fully onchain CLOB perpetual futures exchange on an EVM L1, is integrating Fun.xyz as its deposit infrastructure. From day one of the mainnet launch on Monad, users will be able to fund their accounts from 11+ chains, 20+ tokens, credit/debit cards, SEPA bank transfers, and centralized exchange accounts — all through a single, unified flow embedded directly in the trading interface. Every asset is automatically converted into AUSD, the protocol’s collateral token, and delivered to the user’s Monad wallet.

What is Perpl?

Perpl is a high-performance, fully decentralized perpetual futures (perps) exchange built natively for Monad, an open, permissionless, geographically distributed EVM Layer 1 blockchain with fast finality and 10,000+ TPS capacity. The platform is designed to deliver CEX-quality trading UX without compromising on decentralization.

Unlike other perpetual DEXs that rely on off-chain matching engines, app-chains, or AMM-based pricing, everything on this exchange happens entirely on-chain. It runs a central limit order book (CLOB) on Monad’s L1 — every order submission, cancellation, match, and settlement is executed and verifiable onchain with no off-chain or centralized points of failure.

The order book architecture is purpose-built for gas efficiency on EVM. A market maker post-and-cancel operation costs approximately 100k gas including solvency checks — for reference, a simple Uniswap V2 AMM swap costs roughly 200k gas. The order book achieves O(1) constant-time posting, O(1) constant-time cancellation, and supports over 16 million price levels, enabling granular quoting down to dime ($0.10) increments on large assets like Bitcoin.

This gas efficiency translates directly into tighter spreads for traders. When market makers can cancel and repost orders cheaply, they can quote more aggressively, which means better fill prices for everyone. The protocol further optimizes this with a “Change” operation that replaces the traditional cancel-and-repost with a single transaction that moves order storage rather than deallocating and reallocating it.

Perpl’s risk management stack includes a dynamic margin engine with isolated margin (cross and hybrid margin planned), an onchain liquidation system with partial and full liquidation support, a per-perpetual insurance fund, auto-deleveraging (ADL) for extreme market conditions, and a withdrawal rate-limiting mechanism that protects protocol funds during potential security incidents. The exchange also supports a full suite of order types including market, limit, stop market, stop limit, take profit, and TWAP (coming soon).

For a deeper technical overview of the architecture, visit the Perpl documentation.

The Deposit Problem in DeFi

Onboarding onto a new chain has historically been one of the highest-friction experiences in DeFi. The typical flow for a user who wants to trade on a protocol deployed on a newer L1 looks something like this: find a bridge that supports the destination chain, move assets from the source chain, swap into the correct token, acquire gas tokens, and then finally fund the trading account. Each of these steps involves a separate application, a separate transaction, and a separate opportunity for confusion, error, or abandonment.

For users coming from centralized exchanges, the experience is often worse. Many CEXs do not support direct withdrawals to newer chains, forcing users to withdraw to an intermediate chain, then bridge from there. For users with no existing crypto holdings who want to enter DeFi for the first time, the barrier is even higher — they need to find a fiat on-ramp, purchase crypto, transfer it to a self-custodial wallet, and then navigate the bridging flow described above.

This friction is not a minor UX inconvenience. It is the primary reason that liquidity on newer chains remains fragmented and that DeFi protocols on those chains struggle to attract users who would otherwise be interested in the product. For a perpetual futures exchange designed to compete with centralized platforms on execution quality, having an onboarding experience that requires five separate steps across three separate applications is a fundamental contradiction.

Prior to this integration, getting started on Perpl required users to already have AUSD on Monad. Traders on Ethereum, Solana, Arbitrum, Base, or any other chain had to independently bridge their assets to Monad and convert to AUSD before they could begin trading. Users without existing crypto on Monad had no direct path in at all.

What is Fun.xyz?

Fun.xyz builds unified deposit infrastructure for crypto applications. Their core thesis is that for a blockchain-first global economy to function, value exchange must be intuitive, secure, and seamless. They have built two primary products to realize this vision: Checkout and Universal Deposit Addresses (UDA).

Together, these products allow any application to accept funds from any source — any chain, any token, any fiat payment method — through a single integration. The bridging, swapping, and routing complexity is abstracted away entirely from the end user. All assets are automatically converted into the destination token — in this case, AUSD on Monad. Fun.xyz supports both EVM and non-EVM chains and operates exclusively on mainnets. Their current chain coverage includes Ethereum, Polygon, Base, Arbitrum One, Optimism, Binance Smart Chain, HyperEVM, Abstract, Katana, Ethereal, Solana, and Bitcoin.

The Perpl x Fun.xyz Integration: What Users Get

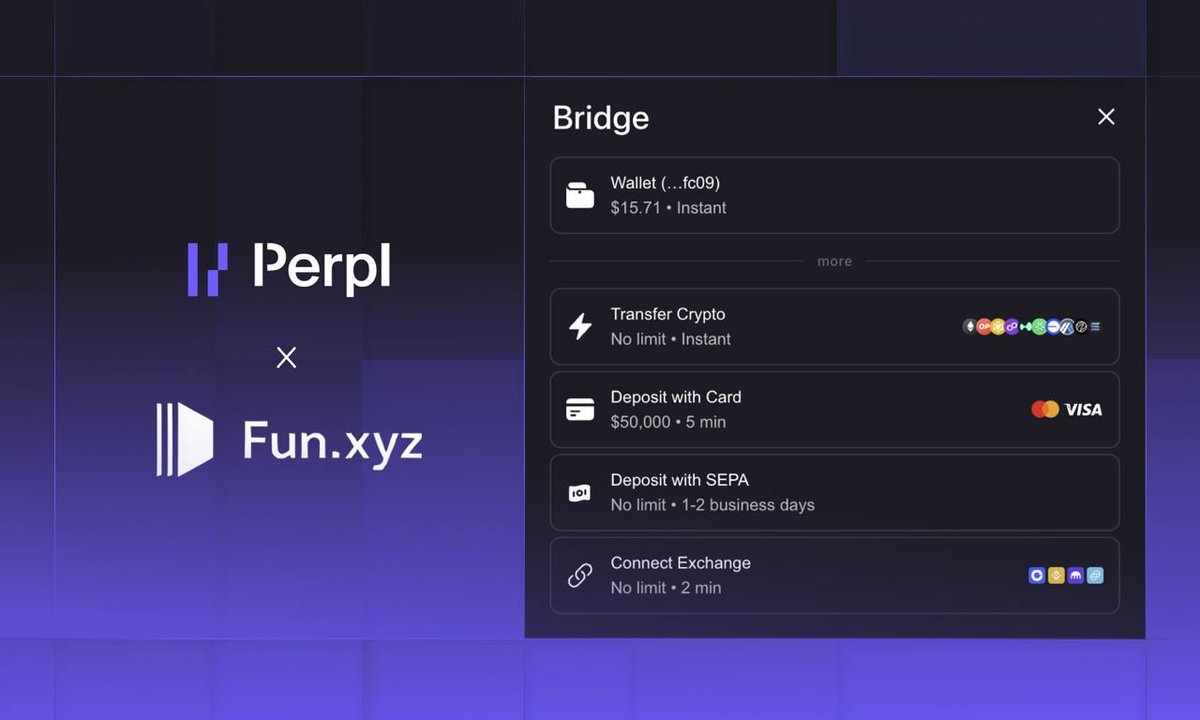

By integrating Fun.xyz, the exchange now offers a comprehensive, unified onboarding experience directly within the trading interface. Users no longer need to leave the platform to bridge, swap, or on-ramp funds. Every funding method is accessible from a single modal.

Cross-Chain Crypto Transfers

Users can fund their accounts using crypto assets from any of Fun.xyz’s supported source chains. The integration supports a wide range of tokens including USDC, USDT, ETH, BTC, SOL, DAI, WETH, WBNB, HYPE, ARB, BNB, MATIC, POL, BUSD, CBBTC, UBTC, USDe, USDC.e, and others.

Supported source chains include Polygon, Ethereum, Solana, BSC, Base, Arbitrum, Optimism, HyperEVM, Abstract, Ethereal, and Bitcoin. Minimum thresholds are kept low: $3 on most chains, with $10 minimums on Ethereum and Bitcoin. The user selects their source token and chain, and Fun.xyz handles the bridging and conversion automatically — converting assets into AUSD, which arrives in the user’s Monad wallet ready for trading.

CEX Transfers

Users can connect their centralized exchange accounts and move funds directly to the platform with no upper limit and approximately 2-minute processing time. This eliminates the need to withdraw from a CEX to an intermediate wallet, then bridge to Monad manually.

Visa Card On-Ramp

Card payments are supported for up to $50,000, with approximately 5-minute processing time. This provides a direct fiat-to-trading path for users who are new to crypto or who prefer not to manage cross-chain transfers. No prior crypto holdings are required.

SEPA Bank Transfers

Users can on-ramp via SEPA with no upper limit. Processing takes 1-2 business days. This is an additional fiat entry point for users who prefer traditional banking rails over card payments.

Why This Matters: Onboarding Philosophy for Perpetual Futures on Monad

The Fun.xyz integration is not just a feature addition. It is a foundational component of how Perpl thinks about user onboarding and liquidity.

As founder pbj put it: “You can seamlessly bridge, swap, and buy assets in one easy-to-use interface to get your trading margin on Perpl with Fun.xyz.”

Eliminating Liquidity Fragmentation

One of the structural challenges for any protocol on a newer chain is that user capital is distributed across dozens of chains and hundreds of tokens. If a protocol only accepts funds from its native chain, it is competing for a small slice of total available liquidity. By accepting capital from effectively anywhere — any chain, any token, any fiat source — the exchange removes the chain-of-origin as a barrier to participation. Capital can flow into the order book from wherever it currently sits, which directly benefits liquidity depth and execution quality for all traders.

Lowering the Barrier for Non-Crypto-Native Users

The ambition behind Perpl is to build a perpetual futures exchange on Monad that can compete with centralized platforms on UX. That ambition is meaningless if the first step — getting funds onto the platform — requires navigating bridges, gas tokens, and chain-specific wallets. With card and SEPA support, a user with no crypto holdings can go from zero to trading perpetuals in minutes. This is a meaningful expansion of the addressable user base.

Future-Proofing the On-Ramp Layer

Fun.xyz continuously adds support for new chains and tokens. As their coverage expands, the exchange’s funding options expand automatically without requiring additional integration work. This means the protocol does not need to build and maintain individual bridge integrations for each new chain — an approach that does not scale and introduces additional security surface area.

Consistency With Decentralization Principles

Perpl is built on the conviction that a fully onchain, decentralized exchange can deliver CEX-quality. The Fun.xyz integration extends this principle to the on-ramp layer. Users retain custody of their assets throughout the funding flow, and no centralized intermediary holds funds at any point during the bridging or conversion process.

How to Get Started: Fund Your Account and Trade

The Fun.xyz integration will be live from day one of Perpl’s mainnet launch on Monad. Here is how to get started:

- Visit perpl.xyz and connect your wallet.

- Click “Bridge” in the top navigation bar. This opens the Fun.xyz modal directly within the interface.

- Choose your funding method: use your connected wallet on Monad, transfer crypto from any supported chain, pay with a Visa card, use a SEPA bank transfer, or connect a centralized exchange account.

- Complete the transaction. Fun.xyz converts your assets into AUSD and delivers them to your Monad wallet.

- Click “Deposit to Enable Trading” in the trading panel. This opens the Create Account modal where you allocate AUSD collateral (minimum 100 AUSD) to the exchange. Enter your amount, confirm the token approval in your wallet, and your account is created.

- Optionally enable One-Click Trading for a smoother experience — this can be changed later in Preferences.

- Select a market, choose long or short, set your position size and leverage, and place your first trade.

For more information on the architecture, order types, fee structure, and risk management systems, visit the Perpl documentation.

Frequently Asked Questions

What is Perpl?

The first fully onchain CLOB perpetual futures exchange, built on Monad. Every order, match, and settlement happens natively on-chain with no centralized components. Learn more about how it compares to centralized exchanges.

Which chains and tokens are supported for funding?

The Fun.xyz integration supports 11+ source chains (including Ethereum, Solana, BSC, Base, Arbitrum, and Bitcoin) and 20+ tokens (USDC, USDT, ETH, BTC, SOL, and more). Fiat options include Visa cards, SEPA transfers, and direct CEX connections. See the full list in the integration details above.

What is AUSD?

AUSD is the collateral token used for margin across all perpetual markets on the exchange. Every funded asset is automatically converted into AUSD. To learn more, read about the partnership with Agora.

Can I start trading without owning any crypto?

Yes. Visa card payments (up to $50,000) and SEPA bank transfers (no upper limit) provide a direct fiat on-ramp. No prior crypto holdings are required.

What are the minimum amounts to get started?

Minimum thresholds vary by source: $3 on most chains, $10 on Ethereum and Bitcoin. A minimum of 100 AUSD is required to create a trading account.

What are perpetual futures?

Derivative contracts that let traders speculate on asset prices with leverage, without owning the asset directly. Unlike traditional futures, perps have no expiration date. Read the full guide on how perpetual futures work.

Follow Perpl on Twitter/X, follow the founder pbj, and join the community on Discord for the latest updates on mainnet and future announcements.